The need for more housing units in Dublin’s city centre and surrounding areas is a huge problem – demand appears to be growing stronger just at a time when the lack of supply is being exacerbated by a dearth of development finance. Tim Cahill, Co-Founder and Managing Director of Grayling Properties discusses how forward funding could be one solution. Read on for the latest on Forward funding and the Irish property market.

It is anticipated that 19,000 – 20,000 new residential units were completed in Ireland in 2020. That’s approximately 14,000 fewer units than what is required each year to meet the population’s housing requirements. This recent research from the Society of Chartered Surveyors Ireland is stark reading, highlighting that this lack of supply, combined with strong demand, is driving house prices higher.

Forward funding and the Irish property market – Narrowing the focus to Dublin

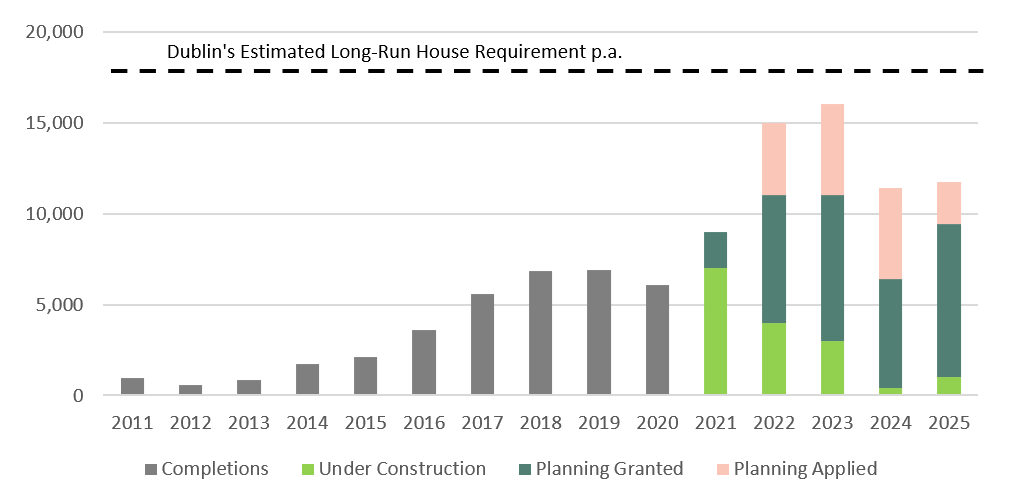

Narrowing the focus down to Dublin, the estimated long-term requirement for new housing is between 15,000-20,000 units a year. We have been delivering well below those figures for a number of years. In 2019 and 2020 combined, less than 15,000 units were completed. Output is not meeting the strong demand, which is being driven by employment and favourable demographics amongst other things, which is placing upward pressure on rents and house prices.

According to our data, currently in Dublin city centre, there is a lot more office space (“desks”) than residential units (“beds”) being built. The “desk-to-bed ratio” compares the amount of office being built vs accommodation – the ratio currently stands at 7.4x for schemes which are under construction (i.e. new employees in Dublin city centre will find it hard to find accommodation or will have to travel a long way to work). If we widen the “bed” criteria to also include schemes which have applied for or have planning, the ratio falls to 3.2x. Of the offices under construction 67% have a pre-committed tenant. Clearly, the amount of units with planning is increasing – but the challenge for the industry is getting these units delivered in a timely manner.

Many developments, that were expected to be completed in 2021/2022, will now be pushed out to 2023 and beyond, not only because of COVID-19, but because of continued difficulty in accessing development finance. This lack of development finance is probably the biggest obstacle facing developers with actionable planning grants trying to deliver new units. This is where the model of forward funding could be one solution — driving life into a struggling housing market, along with having key benefits for the developer and funder too.

WHAT ARE THE BENEFITS OF FORWARD FUNDING?

1: DE-RISKS THE DEVELOPMENT

A forward fund deal is where an investor agrees to buy finished product from a developer – but gets involved from the start of the project, acquiring the site before construction begins and providing the development finance for the life of the project.

When a forward funding deal is put in place, it offers certainty of funding and ultimate exit for the developer. A recent report from the SCSI — Real Costs of New Apartment Delivery — in north Dublin Docklands found that the development costs for a two-bed, high-rise apartment have climbed to more than €550,000 with construction costs accounting for 47% of the overall delivery cost. In a time of rising construction costs, forward funding provides the developer with certainty of funding to efficiently build the property. For the investor, they ‘win’ as they secure the property at an early stage, ensuring they get the best value possible for the development.

2: IMPROVES RETURNS

The party providing the forward funding are offered certainty as result of gaining access to the project in its early stages. They are free to negotiate directly with the developers on the plans for construction, suiting their specific requirements. Through forward funding the investor acquires the scheme at higher initial yield thus driving better returns over the life of their investment.

3: SPEEDS UP THE PROCESS

The process of acquiring land, developing the units and delivering accommodation can be sped up substantially through forward funding deals. Rather than three parties — developer, bank and purchaser — there are now just two. The purchaser and developer can work directly together and put plans in place to meet timelines, reach targets and resolve issues quicker than what would be possible with larger lending institutions.

Forward funding and the Irish property market

Forward Funds are a relatively new concept in Ireland – but have been popular in many European markets (including the UK) for some time. We expect them to become more prevalent in Ireland as it provides a favourable solution for both the developer (secures stable development finance and certainty of exit) and the investor (acquires product at attractive levels). Furthermore, they could be a powerful tool in combating the lack of supply in the housing market – most likely for large scale projects in urban locations (e.g. Dublin, Galway or Cork city centres).